International trade transactions often involve the use of financial instruments called Letter of Credits (LCs) to provide an extra layer of security due to the assurance of the banks involved in trade. However, when a transaction takes place between the buyer and the seller, keeping an intermediary in the loop, the LC used in such cases is known as a ‘Back to Back letter of credit’. In this article, we will discuss Back to Back LCs in detail, including how they work, terms and conditions, contents in a Back to Back Letter of Credit format, an example of Back to Back LCs, risks involved, and the difference between Back to Back LCs and Transferable LCs.

How do Back to Back LCs work?

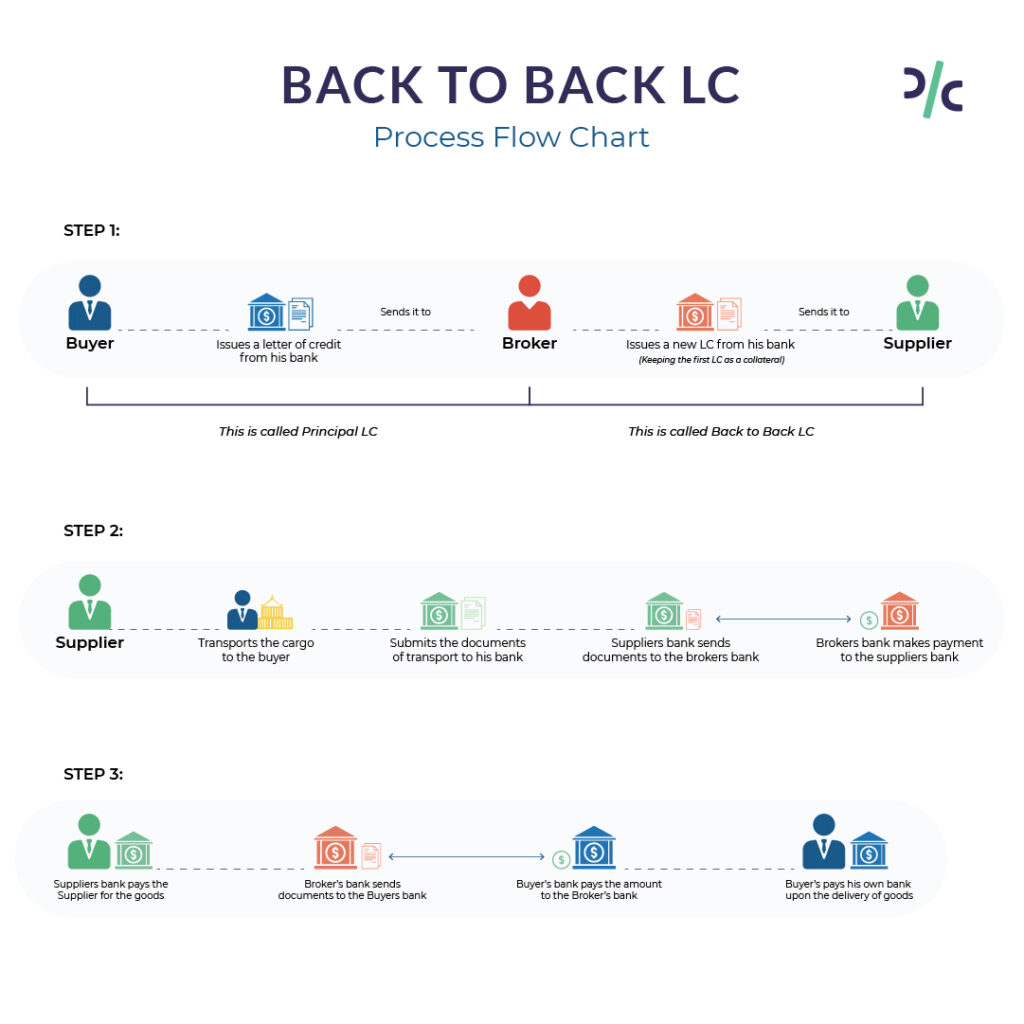

A Back to Back LC is a two-step process. First, the buyer issues a primary LC, also known as the master LC, to the broker. Next, the broker issues a second LC, known as the back to back LC, to the supplier, keeping the primary LC as collateral. The supplier transports the cargo to the original buyer, submits the documents of transport like the bill of lading, etc. to its bank. The supplier’s bank then sends the documents to the broker’s bank, which upon carefully scrutinizing the documents, makes the payment to the supplier’s bank. The supplier’s bank pays the supplier for the goods. The broker’s bank then sends the documents to the buyer’s bank. The bank scrutinizes the documents and pays the broker’s bank the amount listed in the principal LC. The buyer pays the buyer’s bank the money upon the delivery of goods.

Terms and conditions under Back to Back LC

A Back to Back LC is issued only at the request of the beneficiary of the principal LC- the intermediary. All LCs are issued evaluating the creditworthiness of the applicant. There should be no disparity in the details such as product descriptions, product quantity, terms, and conditions of the trade, etc. in the LCs. The value of a back to back LC can be a maximum of 90% of that of the principal LC. The difference is the broker’s profit margin. It is advisable to keep the date of shipping earlier than the date of payment of the principal LC so that the buyer receives the goods before paying for them. However, the bank is not liable for the product quality, just the documents. Hence, the LC has to be honored even in case of any defects in the products. The expiry date of back to back LC is always earlier than that of the principal LC.

Contents in a Back to Back Letter of Credit format

A Back to Back LC looks just like a normal LC. The only difference is that it is issued by keeping the principal LC as its collateral. It contains beneficiary details, amount, time validity by which payment is to be made to the bank, seller’s bank details, payment mode, list of documents, notifying address, description of goods, and confirmation order from a local bank.

Example of Back to Back LC

Suppose Company A in Germany sells automobile parts, and Company C in Australia wants to buy them, but they are not in direct contact with one another. A broker B in London enters the trade as an intermediary. The broker asks the Australian company C to apply for an LC from a well-known financial institution. The Australian bank issues a principal LC under the broker’s name, and the broker asks his bank to keep the principal LC as collateral and issue a back to back LC to company C, which will supply the goods. Once the supplier receives the back to back LC, they produce the shipment and send it directly to the buyer. Company A gets the money from the bank in Germany, while the buyer — Company C pays the money to the bank in Australia. The broker gets his profit margin, which is the difference between the amounts of both the LCs.

Risks under Back to Back LC

The risks involved in dealing with a back to back letter of credit include expiry date of the master LC, dissimilar terms and conditions of trade, and disparity in documentation. If the expiry date of the master LC has been set without keeping a sufficient buffer period, it may expire before the arrival of documents from the broker’s bank. In such circumstances, the settlement becomes tricky. The terms and conditions of the trade may be dissimilar in the master LC and the back to back LC, or some of the other key details may be different. This leads to disparity in the documentation and often ends up making the settlement process cumbersome.

Difference between Back to Back LC and Transferable LC

A Transferable LC is a type of financial lending instrument where the primary beneficiary can add a secondary beneficiary who is paid the amount either partially or in full. In contrast, the LC used in a back to back transaction is issued by the bank against the primary LC, which acts as collateral. There are two separate LCs involved in the process- Primary LC and back to back LC. Transferable LCs have a single LC involved in the process, and the primary beneficiary can add a secondary beneficiary to receive payment. The issuing bank designates such an LC as transferable at the time of issuing it. Therefore, the transferable LC allows the primary beneficiary to transfer the credit to a third party.

In comparison, the Back to Back LC is used when an intermediary is involved in the transaction. The intermediary, often a broker or trader, acts as a middleman between the buyer and supplier. Instead of issuing an LC to the supplier, the buyer issues it to the intermediary, who then submits the primary LC as collateral at a bank and asks it to issue another LC to be given to the end supplier in exchange for the shipment. This second LC is known as the Back to Back LC.

In summary, a Back to Back LC is a financial instrument used in international trade transactions, where an intermediary is involved. The process involves issuing two separate LCs- a primary LC and a Back to Back LC. While the primary LC is issued by the buyer to the intermediary as collateral, the intermediary issues the Back to Back LC to the supplier, who then delivers the goods to the buyer. Despite the risks involved in dealing with Back to Back LCs, it provides an additional layer of security and helps eliminate credit risk for buyers, suppliers, traders, and brokers.